Are Life Insurance Premiums Tax Deductible?

Life insurance plays a critical role in securing the financial future of your loved ones, but many people often wonder about its tax implications. Specifically, “Are life insurance premiums tax deductible?” refers to whether the payments made for life insurance can reduce your taxable income.

For individuals across the U.S., the answer is generally no—life insurance premiums are considered personal expenses and are not tax-deductible. However, certain business-related life insurance policies, such as key person insurance or group life insurance, may allow for deductions under specific conditions.

In this blog, we’ll break down the tax rules around life insurance premiums for both individuals and businesses, explore any potential exceptions, and provide a clear explanation of the tax implications for life insurance payouts.

General Tax Rules

No, life insurance premiums are not tax-deductible. The IRS considers life insurance premiums to be personal expenses, which means they are not eligible for tax deductions. This rule applies to both term life and permanent life insurance policies. It’s essential to recognize that life insurance can be a crucial tool for financial security, it does not usually provide tax benefits in the form of deductible premiums.

However, the tax treatment may vary depending on whether the life insurance is purchased for individual or business purposes, please take a look:

| Category | Tax Implications | Explanation |

| Individual Life Insurance Premiums | Not Tax-Deductible | Life insurance premiums are considered personal expenses and cannot be deducted from personal income taxes. |

| Business Life Insurance Premiums | Potentially Deductible (with conditions) | Business premiums for policies like key person insurance or group life insurance may be deductible, but only if the business is not the policy’s beneficiary. |

| Death Benefit (Lump Sum Payment) | Not Taxable | The death benefit received by beneficiaries is generally not subject to federal income tax, allowing them to receive the full payout. |

| Interest Earned on Delayed Payouts | Taxable | If the death benefit earns interest before being paid out, the interest portion is taxable as income, while the original death benefit remains tax-free. |

| Estate Taxes on Death Benefit | Potentially Taxable if Estate Exceeds Threshold | If the total estate (including the death benefit) exceeds the federal estate tax exemption ($12.92 million in 2024) or Vermont state threshold ($5 million), estate taxes apply. |

| Group Life Insurance (Employer-Paid) | Taxable for Coverage Over $50,000 | If an employer provides group life insurance, any coverage above $50,000 is considered taxable income for the employee. |

| Life Insurance in Pension Plans | Potentially Deductible | Life insurance included in qualified pension plans may allow for some premium deductions, though specific rules apply. |

| Life Insurance Premiums for Charitable Donations | Deductible (with conditions) | If a life insurance policy is donated to a charity and the charity owns the policy, the premiums paid may be deductible as a charitable donation. |

Are Life Insurance Premiums Tax Deductible for Individuals?

For most individuals, life insurance premiums are not tax-deductible. The IRS treats premiums for personal life insurance policies as non-deductible personal expenses. Whether you own a term life or whole life insurance policy, you cannot deduct the premiums from your taxable income. This holds true regardless of your employment status or income level.

Key Points to Remember:

- Personal life insurance premiums are not tax-deductible.

- Life insurance is considered a personal financial protection tool, not a business expense.

- There are no federal tax breaks for purchasing personal life insurance.

While this may seem discouraging for individuals seeking tax advantages, life insurance still plays a vital role in estate planning and financial protection for beneficiaries.

Are Life Insurance Premiums Tax Deductible for Business Owners?

The tax rules around life insurance premiums change slightly when it comes to businesses. In certain situations, life insurance premiums paid by a business can be tax-deductible, though there are specific conditions.

When Are Premiums Deductible?

- Key Person Insurance: If a business purchases a life insurance policy on an employee whose death would have a significant financial impact on the company, the premiums may be deductible. However, the company must be the beneficiary of the policy.

- Group Life Insurance: Businesses that offer group life insurance plans to employees as part of their benefits package may deduct the premiums they pay, provided the coverage is within certain limits.

When Are Premiums Not Deductible?

- If the business is the direct or indirect beneficiary of the policy, the premiums are generally not deductible.

| Life Insurance Premiums for Businesses | Deductible? |

| Key Person Insurance (business is beneficiary) | Yes, but with limitations |

| Group Life Insurance for employees | Yes, up to $50,000 coverage |

| Personal life insurance for business owners | No |

Tax Implications of Life Insurance Payouts

Life insurance premiums are generally not tax-deductible, the payouts from life insurance policies are typically tax-free. The death benefit, which is paid to beneficiaries upon the insured’s death, is generally not subject to income tax. This makes life insurance an attractive estate planning tool.

Tax-Free Death Benefit

In most cases, the death benefit from a life insurance policy is not subject to federal income tax, meaning beneficiaries receive the full amount of the payout. When the policyholder passes away, the death benefit is typically paid out without any deductions, providing financial relief to the beneficiaries. This tax-free nature is one of the key advantages of life insurance, making it a valuable tool in estate planning and ensuring that loved ones are financially supported without the burden of taxes on the payout. Detailed Explanation Below

Potential Tax on Interest or Dividends

While the death benefit itself is usually tax-free, there are cases where taxes may be incurred. If the life insurance company does not immediately pay out the benefit and instead holds the funds for a period of time, any interest or dividends earned on that benefit could be subject to income tax.

For example, if the insurer offers a delayed payout option where the death benefit accrues interest before it is distributed to the beneficiaries, only the interest earned is taxable, not the original death benefit amount.

Estate Taxes

While the death benefit from life insurance is generally not subject to income tax, it may be included in the estate of the deceased for the purposes of determining estate taxes. This could happen if the insured person owned the policy at the time of their death and their estate’s total value, including the death benefit, exceeds the federal or state estate tax exemption limits.

For 2024, the federal estate tax exemption is approximately $12.92 million. If the value of the estate, including the life insurance payout, surpasses this threshold, any excess amount could be subject to estate taxes. Certain states may also impose their own estate or inheritance taxes with lower exemption limits.

Consulting a Tax Professional

Given the complexities surrounding life insurance payouts and taxes, it is essential for beneficiaries and policyholders to consult with a tax professional or financial advisor. They can provide personalized guidance based on the size of the estate, the structure of the life insurance policy, and the tax laws in place. This can help ensure that beneficiaries maximize the value of the payout while minimizing any tax liabilities.

Professional advice can help navigate the intricacies of tax laws, ensuring beneficiaries do not face unexpected tax burdens or estate complications. For high-net-worth individuals, effective estate planning with the help of a financial advisor can ensure that life insurance is used as a powerful, tax-efficient financial tool.

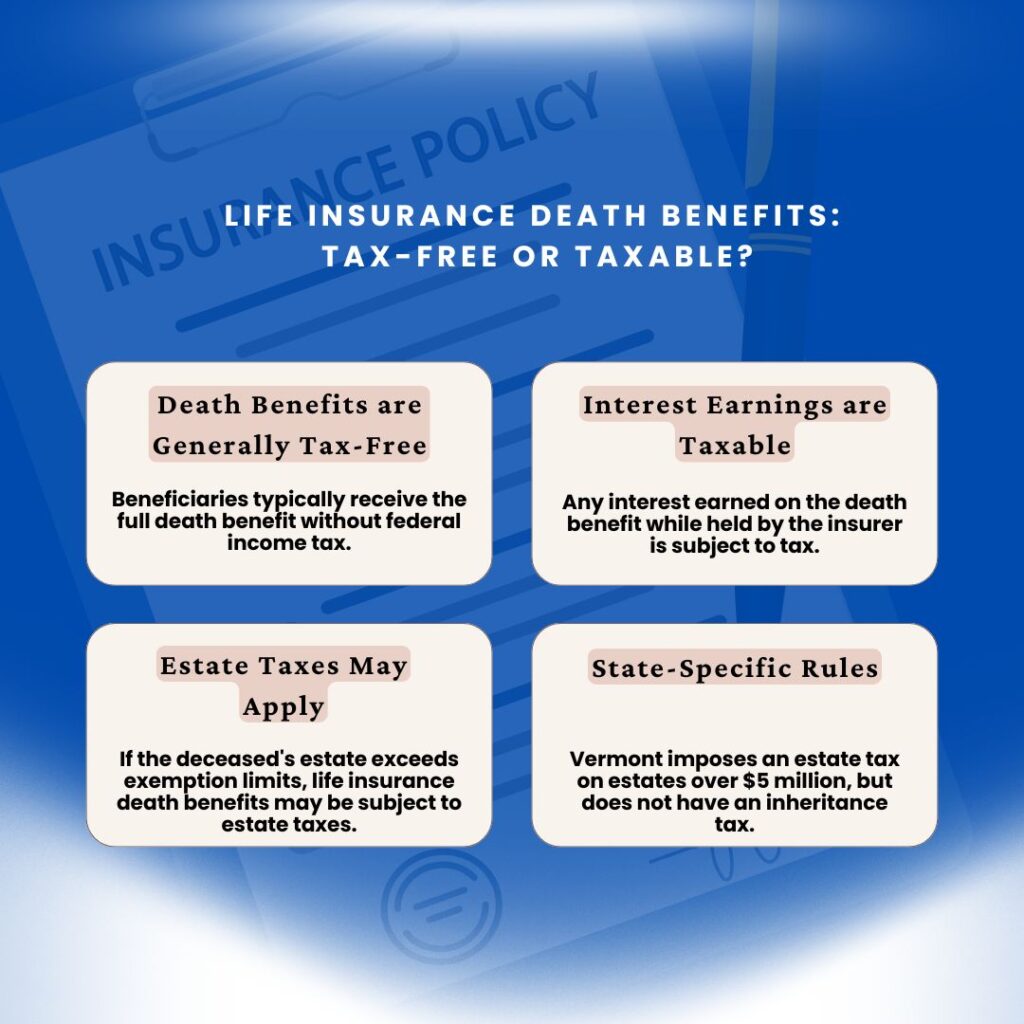

Are Life Insurance Death Benefits Taxable?

In most cases, life insurance death benefits are not taxable. When a policyholder passes away, the beneficiaries typically receive the death benefit as a lump sum or installments, and these payments are not subject to federal income tax. This is one of the major advantages of life insurance providing financial security to beneficiaries without a tax burden.

However, there are certain situations where taxes might come into play:

- Interest Earnings: If the life insurance company holds the death benefit for a period and it accrues interest, the interest earnings are subject to income tax. The original death benefit remains tax-free, but any interest on that amount will be taxed.

- Estate Taxes: While life insurance death benefits are generally not subject to federal income tax, they may be included in the deceased’s estate for estate tax purposes if the total estate value exceeds federal or state exemption limits.

For 2024, the federal estate tax exemption has increased to $13.61 million per individual and $27.22 million per married couple, meaning estates below these thresholds will not be subject to federal estate taxes. Additionally, the estate tax exemption is portable between spouses, allowing the surviving spouse to use the deceased spouse’s unused portion of the exemption, provided it is claimed on a timely-filed estate tax return.

However, it’s important to note that this higher exemption amount is scheduled to drop significantly on January 1, 2026 to around $5 million per person, indexed for inflation, unless new tax legislation is passed.

Key Takeaways:

- Death benefits are generally tax-free for beneficiaries.

- Any interest earned on the death benefit before it is paid out is taxable.

- Vermont does not have an inheritance tax, but it imposes a state estate tax on estates exceeding $5 million.

By understanding these potential tax scenarios, beneficiaries and policyholders can plan accordingly to maximize the financial protection life insurance offers.

Exceptions for Tax-Deductible Life Insurance Policies

While life insurance premiums are not usually tax-deductible for individuals, there are some exceptions where tax deductions may apply:

- Policies within Pension Plans: If life insurance is purchased as part of a qualified pension or retirement plan, the premiums may be tax-deductible. However, specific rules apply, and it’s essential to consult with a tax advisor.

- Charitable Contributions: In some cases, life insurance premiums may be deductible if the policy is donated to a charitable organization. The policy must be owned by the charity, and the premiums must be paid by the donor.

These exceptions are rare, and individuals should seek professional advice before assuming life insurance premiums will be deductible.

Conclusion

In summary, while life insurance premiums are typically not tax-deductible for individuals, there are specific scenarios where businesses may benefit from deducting premiums for key person or group life insurance. Additionally, life insurance payouts in Vermont are usually tax-free, making them a valuable tool for protecting beneficiaries and planning for the future. It’s always wise to consult with a tax professional to understand the full scope of the tax implications related to life insurance.