Can you cancel an auto insurance claim?

Filing an auto insurance claim is typically a straightforward process designed to help you recover from unexpected damages or losses. However, there are instances when you might reconsider after filing. The damages may turn out to be minor, making it more cost-effective to pay out of pocket rather than dealing with the deductible. Maybe you’re concerned about how filing a claim could affect your premiums in the future. Or you might have resolved the issue independently without needing your insurer’s intervention. In such cases, you may ask yourself, “Can you cancel an auto insurance claim?”

Here, we’ll explore the circumstances under which you can cancel an auto insurance claim, the potential consequences, and the proper steps to ensure the process is handled smoothly and professionally. Whether you’re navigating a minor fender bender or a more significant incident, this guide will provide you with the clarity you need to make an informed decision.

Can you cancel an auto insurance claim?

Yes, you can cancel an auto insurance claim under specific circumstances, but timing is crucial. Cancellation is generally allowed if your insurance company has not yet started processing the claim or issued a payout. This means that if you file a claim but later decide you no longer wish to pursue it, perhaps because the repair costs are manageable without assistance or you fear an increase in your premiums, you can request to cancel. However, once the insurance company has taken significant steps, such as issuing a payment for the claim, the process becomes irreversible. This is because the claim is considered finalized, and the payout is a contractual obligation that cannot be undone.

It’s important to act quickly if you decide to cancel a claim. Contact your insurance provider as soon as possible to inquire about the status of the claim and confirm that no actions have been completed that would prevent cancellation. Most insurance companies have clear guidelines for such situations, and their customer service teams can walk you through the cancellation process.

Steps to Cancel an Auto Insurance Claim

If you’ve decided to cancel your auto insurance claim, following these steps makes certain the process is handled smoothly and professionally:-

| Claim Stage | Can You Cancel? |

| Before Claim Approval | Yes, you can cancel easily, as no payouts or decisions have been made. |

| After Approval but Before Payment | Possible, but may require formal communication with your insurer. |

| After Payment | No, as the claim is finalized and recorded in your insurance history. |

- Contact your insurance provider: As soon as you decide to cancel, reach out to your insurer promptly. Most providers offer customer service hotlines, mobile apps, or online portals for quick communication. Acting quickly minimizes the chances of the claim being processed before your request.

- Provide Claim Details: When contacting your insurer, have all relevant information ready, including your claim number, policy number, and any other details related to the claim. Providing accurate information helps the representative locate your file quickly and process your request efficiently.

- Explain the reason for cancellation: Insurers will typically ask why you want to cancel the claim. Common reasons include discovering that the damages are minor, deciding to handle the repair costs yourself, or concerns about premium increases. Clearly explaining your reason can help ensure the process is straightforward.

- Request Written Confirmation: When cancelling an auto insurance claim, it’s essential to request written confirmation from your insurance provider. This step makes sure there is a clear record of your request and the cancellation’s completion. Having written documentation protects you from potential disputes or misunderstandings later.

- Verify and Confirm Cancellation: Always request written confirmation of the cancellation, whether through email or official documentation. This guarantees that there is no confusion about the status of your claim and provides you with proof of the cancellation in case of any discrepancies later.

Factors to Consider Before Cancelling a Claim

- Deductible vs. Repair Cost

If your insurance policy includes a deductible say $500 and the estimated repair cost is only $300, filing a claim may not be financially beneficial. In this scenario, you would pay the entire repair bill out of pocket, as it falls below your deductible. Cancelling the claim and handling the repair costs yourself is often the more practical choice, saving you from unnecessary paperwork or potential premium hikes.

- Premium Increases

It’s common for insurance companies to raise your premiums after a claim, especially if you are deemed at fault. Cancelling a claim for minor damages can help you avoid this increase. However, weigh this decision carefully, as avoiding a claim for a significant incident may not be worth the risk of covering extensive repair costs independently.

- Third-Party Damages

If your claim involves damages to another party—such as another driver’s vehicle, property, or injuries—cancelling is often not an option. These claims typically involve legal and financial obligations, and the insurance company is required to address the third party’s damages. Once a third-party claim is filed, the process must proceed to resolution to meet these legal responsibilities.

- Accident Record

Even if you cancel your claim, the incident itself may still be recorded by your insurance company. This record could influence future insurance rates, as providers assess your risk profile based on your history. It’s essential to confirm with your insurer how a cancelled claim or recorded incident might impact your policy renewal or future premiums.

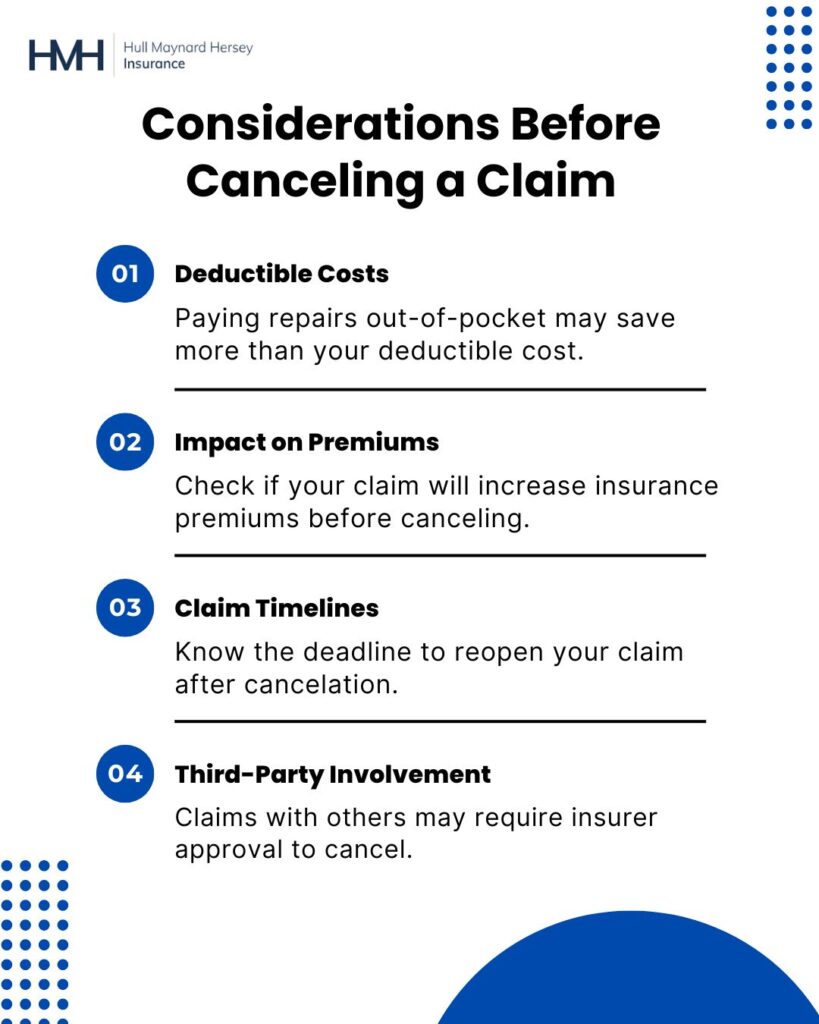

Considerations Before Canceling a Claim

Cancelling an auto insurance claim is a significant decision that requires careful consideration of several key factors. Before proceeding, it’s important to assess the following considerations to guarantee that canceling is the best course of action for your specific situation:

- Deductible Costs

Compare your deductible to the shown cost of repairs. It can be more cost-effective to pay for the repairs out of pocket if the costs are less than or only marginally higher than your deductible. By using this strategy, you may be able to prevent the possible premium hikes that come with making a claim.

- Impact on Premiums

Claims can sometimes lead to higher premiums, but this isn’t always the case. For example, if you’re not at fault in the incident, your premium may remain unaffected. Before cancelling the claim, confirm with your insurance provider whether filing it would impact your future premium rates.

- Claim Timelines

It’s important l to understand the timeline for reopening a claim if you decide to cancel it now. Some insurance providers allow a limited window to reactivate a claim. Knowing this time-frame can provide flexibility should you decide to revisit the claim later.

- Third-Party Involvement

If the claim involves another party such as in an accident where fault is discussed or damages extend beyond your vehicle, canceling the claim may not be straightforward. In such cases, the insurer might need to resolve liability issues or gain the consent of the involved parties before agreeing to cancel the claim.

Tips to Avoid Filing Unnecessary Claims

Claiming your auto insurance is a significant choice that may affect your coverage history and premiums for some time to come. The following expert advice can help you make the right decision and prevent needless claims:

- Assess Damages

Before contacting your insurance provider, obtain a professional repair estimate to understand the extent of the damages. Knowing the cost of repairs helps you determine whether filing a claim is necessary, especially if the expenses are manageable out of pocket. This step ensures that you don’t initiate a claim prematurely, which could affect your record even if you later decide not to proceed.

- Understand Your Deductible

Review your policy details, particularly your deductible—the amount you’re required to pay before your insurance covers the rest. If the repair costs are close to or less than your deductible, filing a claim might not be financially beneficial. Understanding this aspect of your policy empowers you to make a cost-effective decision.

- Consult Your Insurer

If you’re unsure about the potential consequences of filing a claim, reach out to your insurer for guidance. Inquire about how filing might affect your premium rates and policy terms. Many insurers offer advice on scenarios that could or could not trigger premium increases, helping you weigh your options before taking any action.

Final Words

Yes, you can cancel an auto insurance claim under most circumstances, but timing and policy details matter. Before making a decision, weight the financial and practical implications carefully. So, Can you cancel an auto insurance claim? If you’re unsure about canceling or need guidance, we at Hull Maynard Insurance Agency in Rutland can help you navigate the process and provide tailored advice to protect your interests. By understanding the claims process and your rights as a policyholder, you can make informed decisions that align with your financial and insurance goals.