How much is life insurance per month?

Life insurance is one of the most essential financial tools for protecting your family’s future and ensuring long-term stability. Whether you’re planning for your children’s education, covering outstanding debts like a mortgage, or preparing for unforeseen events, life insurance offers a reliable safety net. It guarantees that your loved ones will be financially supported in the event of your untimely passing. However, a common concern for many people exploring coverage options is: How much is life insurance per month?

Understanding the monthly life insurance cost is crucial when comparing policies and budgeting for long-term financial planning. The cost isn’t the same for everyone it depends on a variety of factors including your age, health condition, lifestyle choices, and the type of life insurance policy you choose, such as term or whole life. In this blog, we’ll break down how life insurance works, what impacts the monthly premium, and how to choose the right coverage for your unique needs.

How much is life insurance per month?

The average life insurance cost per month can vary significantly based on factors such as age, gender, health, coverage amount, and policy type. Below is a breakdown of typical monthly life insurance premiums for a 20-year term policy worth $500,000:

| Age | Gender | Term Life (Monthly) | Whole Life (Monthly) |

| 25 | Male | $18 – $25 | $140 – $180 |

| 25 | Female | $15 – $22 | $125 – $165 |

| 35 | Male | $25 – $35 | $180 – $230 |

| 35 | Female | $22 – $30 | $165 – $215 |

| 45 | Male | $50 – $65 | $280 – $360 |

| 45 | Female | $40 – $55 | $260 – $340 |

Term Life Insurance

Term life insurance is a straightforward and affordable form of life insurance that provides coverage for a specified period—usually 10, 20, or 30 years. If the policyholder passes away during the term, the insurer pays a death benefit to the beneficiaries. One of the main advantages of term life insurance is its lower cost compared to whole-life policies, making it ideal for young families or individuals seeking temporary financial protection.

When evaluating how much is life insurance per month, term policies often start as low as $15 to $30 per month for healthy individuals in their 20s or 30s. The premium remains fixed throughout the term, making it easy to budget. However, if the policy expires and you still need coverage, you’ll need to renew at a higher rate or convert to a permanent policy. Term life insurance is best suited for covering temporary needs such as mortgage payments, income replacement, or children’s education.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides lifetime coverage along with a cash value component that grows over time. Unlike term life, whole life insurance does not expire as long as premiums are paid. It offers guaranteed death benefits and a fixed premium, making it a stable and predictable financial tool.

When determining how much is life insurance per month, whole life premiums are significantly higher—typically ranging from $125 to $360 monthly for a $500,000 policy depending on age and health. However, the higher cost is justified by the long-term benefits, including wealth accumulation through the policy’s cash value, which can be borrowed against or withdrawn under certain conditions.

Whole life insurance is ideal for individuals seeking lifelong protection, estate planning advantages, or a tax-deferred savings element. It’s especially beneficial for those who want to leave a legacy or ensure permanent financial support for their family.

How to Calculate How Much Life Insurance You Need?

Understanding how to calculate how much life insurance you need is a critical step in making sure your family is financially protected. Instead of choosing a random figure, use the following key pointers to determine the right amount of coverage based on your unique situation:

Multiply Your Annual Income by 10 to 15

A widely accepted starting point is to multiply your current annual income by 10 to 15. This ensures your loved ones can continue their lifestyle without facing financial stress.

- For example, if you earn $70,000 annually, 15× your income equals $1,050,000 in coverage.

- This method is especially useful for primary earners in the household.

While this rule provides a general baseline, it doesn’t account for individual debts, expenses, or savings—which is why further steps are necessary to fine-tune your life insurance coverage.

Add Outstanding Debts and Future Financial Obligations

Next, list all your current and foreseeable financial obligations:

- Mortgage or home loan balances

- Auto loans, personal loans, and credit card debt

- Children’s college tuition or higher education

- Planned family expenses, such as weddings or business investments

Adding these ensures your family won’t inherit debt or struggle to meet essential commitments. This significantly influences both the total amount of coverage needed and how much is life insurance per month when selecting your policy.

Include Final Expenses

Many people overlook final expenses when calculating their life insurance needs. However, funeral costs, medical bills, and legal fees can range from $10,000 to $20,000 or more.

Including these in your coverage ensures that your loved ones won’t need to dip into savings or take on debt during a difficult time.

Subtract Your Existing Assets

To avoid over-insuring, subtract your current financial assets from your total coverage estimate. These may include:

- Savings accounts

- Retirement funds (401(k), IRA, pension)

- Investments (stocks, mutual funds, real estate)

- Existing life insurance policies through your employer

This step gives you a net insurance need, ensuring you’re only paying for the coverage necessary to bridge the financial gap.

Use a Life Insurance Needs Calculator

If you’re unsure where to start, many insurance companies provide free life insurance needs calculators on their websites. These tools simplify the process by:

- Asking for your income, debts, and expenses

- Factoring in family size, age, and long-term financial goals

- Giving you a personalized recommendation

This can also help you preview how much is life insurance per month for various policy options.

Adjust Based on Policy Type and Duration

Finally, your coverage amount should align with the type of policy you choose:

- Term Life Insurance: Match the coverage duration with your major financial responsibilities (e.g., 20 years until mortgage payoff or kids’ college graduation).

- Whole Life Insurance: Consider lifelong needs like estate taxes, wealth transfer, or caring for dependents with special needs.

Choosing the right policy type affects both your monthly premium and the long-term effectiveness of your life insurance strategy.

Life Insurance Needs Calculator Table

| Financial Factor | Amount ($) |

| Annual income x 10 (replacement) | $600,000 |

| Mortgage balance | $200,000 |

| Children’s education | $100,000 |

| Other debts | $50,000 |

| Final expenses (funeral, medical) | $15,000 |

| Savings and assets | -$100,000 |

| Total Life Insurance Needed | $865,000 |

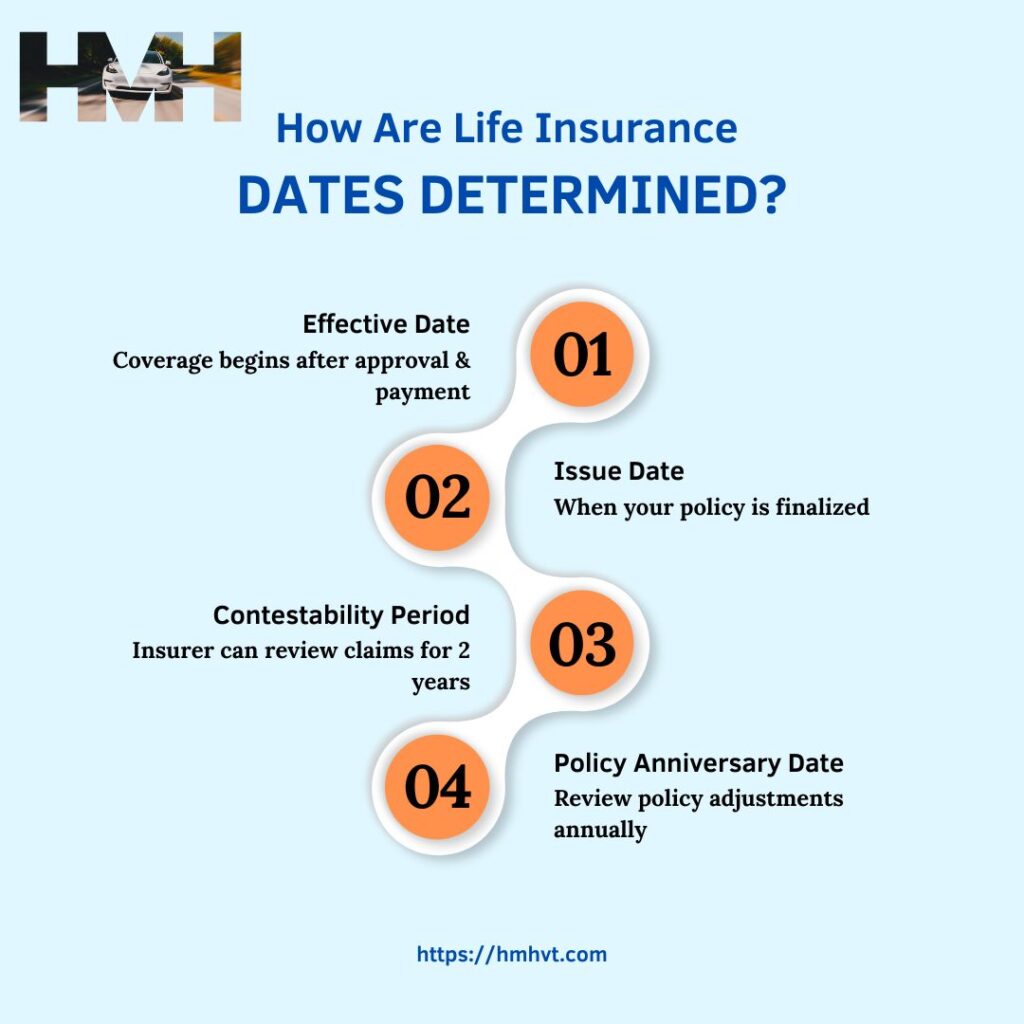

How Are Life Insurance Dates Determined?

The start date of your life insurance policy typically begins once your application is approved, the underwriting is complete, and you make your first premium payment.

Effective Date

The effective date is the day your life insurance coverage officially begins. It marks the point from which the insurer is legally obligated to pay a death benefit if the insured person passes away. This date is determined after your application is approved, underwriting is completed, and the initial premium payment has been received.

It’s crucial to note that coverage does not begin on the day you apply, but only after all requirements are fulfilled. Policyholders should carefully review the effective date mentioned in the insurance documents to avoid any gaps in protection. If there’s a delay in making the first payment or submitting medical exams, the effective date may be pushed back. This date also determines when your premiums are due and may affect eligibility for future policy features, such as cash value accumulation or riders.

Issue Date

The issue date is the day your insurance company finalizes and formally issues your policy. It follows the underwriting process and acceptance of your application. Unlike the effective date, which signals the start of coverage, the issue date is primarily administrative—it shows when your policy was prepared and activated in the insurer’s system. This date is important for record-keeping and can also influence billing cycles, renewal dates, and policy servicing timelines.

In many cases, the issue date and effective date may fall on the same day, but not always. Policyholders should refer to both dates in the policy documents to understand when administrative processing occurred versus when coverage officially began. Keeping track of the issue date can also be useful when applying for future financial products or evaluating how long your policy has been active.

Contestability Period

The contestability period is a critical timeframe typically the first two years from the policy’s effective date during which the insurance company has the right to investigate and potentially deny a claim. If the insured dies during this period, the insurer may review the original application to check for any misrepresentations, omissions, or fraud. This doesn’t mean claims are automatically denied; rather, it allows the insurer to verify the accuracy of the provided information.

If inconsistencies are found, the claim may be reduced or rejected. After the contestability period ends, the policy becomes “incontestable,” meaning the insurer must pay out the claim, assuming the policy was in good standing. It’s essential to be honest and thorough when applying for coverage to avoid complications during this period. Policyholders should also be aware that reinstated policies may reset the contestability window, so understanding this timeframe is vital for long-term protection.

Policy Anniversary Date

The policy anniversary date is the annual marker of when your insurance policy was issued. It typically occurs on the same day each year and is used by the insurer to manage various aspects of your coverage. This includes evaluating potential premium adjustments, reviewing benefit increases (if applicable), issuing annual statements, and resetting any annual coverage benefits.

For policies with cash value, such as whole life or universal life insurance, the anniversary date also serves as a point for calculating interest accumulation and dividend eligibility. Many policyholders choose to schedule policy reviews around this date to assess whether their coverage still meets their needs. Additionally, some policy changes like converting term to permanent insurance may need to be made before or on the anniversary to avoid additional underwriting. Keeping track of the anniversary date ensures you stay on top of important policy changes, premium schedules, and renewal opportunities.

Tips to Get Affordable Monthly Life Insurance

If you’re concerned about how much life insurance is per month, there are ways to lower your costs while still getting reliable coverage:

- Buy Early

Premiums increase with age. Buying in your 20s or 30s can lock in low rates.

- Choose Term Life

If you’re on a budget, term life is the most affordable life insurance option.

- Improve Your Health

Non-smokers and those with healthy lifestyles get better rates.

- Compare Multiple Quotes

Use online comparison tools or work with a broker to find the best deal.

- Opt for Annual Payments

Some insurers offer discounts if you pay yearly instead of monthly.

- Avoid Riders You Don’t Need

Riders like accidental death or waiver of premium can increase your monthly cost.

- Bundle with Other Policies

Some insurers offer discounts if you also have auto or home insurance with them.

Being strategic can make a big difference in monthly life insurance premiums and help you get maximum value for your money.

Final Words

So, How much is life insurance per month? The cost varies based on your age, health status, lifestyle, coverage amount, and the type of policy you choose term or whole life. On average, a healthy person in their 20s or 30s can expect to pay between $20 and $60 per month for term life coverage, while whole life insurance is typically more expensive.

Understanding these variables is key to making informed decisions. By assessing your financial needs, comparing quotes, and securing coverage early, you can lock in a lower premium and ensure long-term protection. Whether you’re buying life insurance for income replacement, debt coverage, or legacy planning, choosing the right policy matters.

Remember, life insurance is more than just a monthly payment—it’s a long-term commitment to your family’s financial security. Take the time to choose wisely and ensure your loved ones are protected when it matters most.